Estimated reading time: 3 minutes

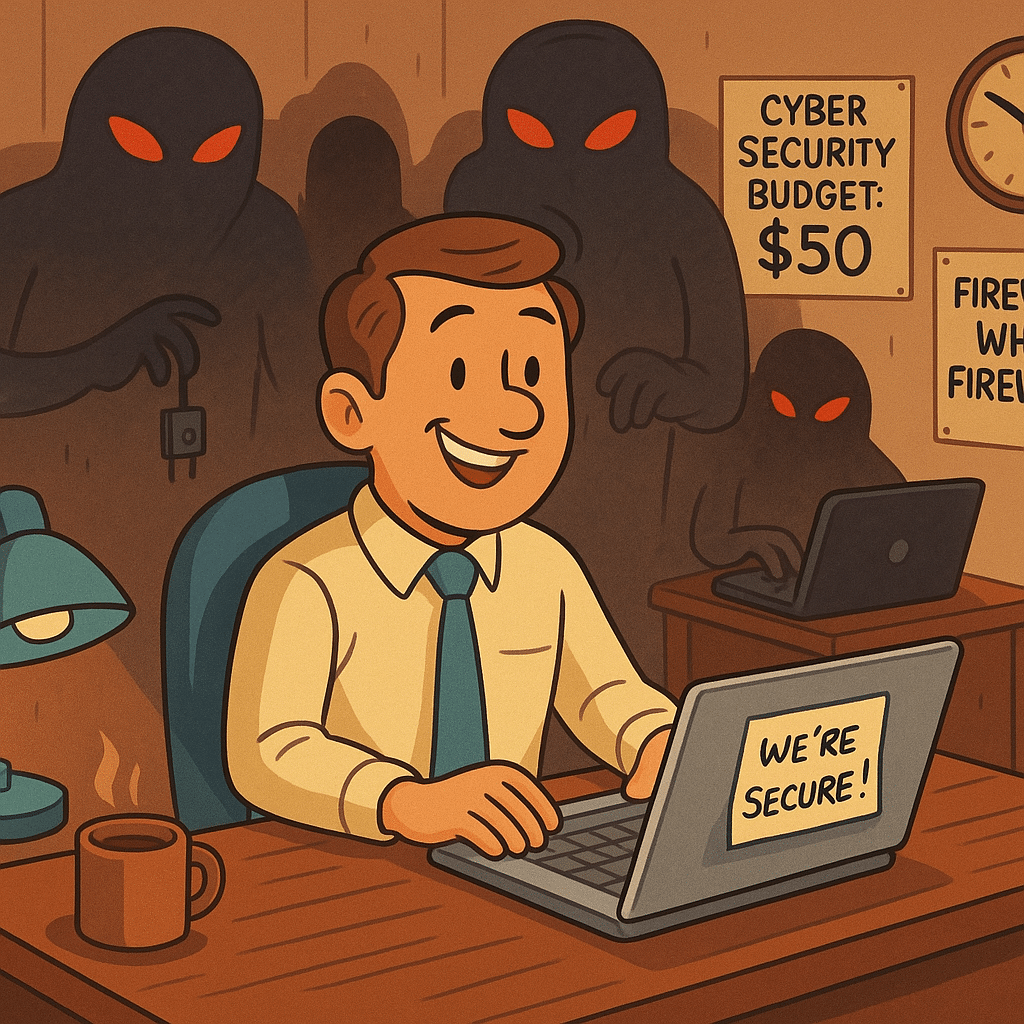

“It Won’t Happen to Me.” Are we all teenagers at heart?

Most small business owners feel safe from cyber risk. They shouldn’t. A new study exposes how misplaced confidence leaves digital doors wide open. Recent research by Coalition, the Small Business Cybersecurity Study, reveals a glaring gap in how small businesses perceive and respond to cyber threats. Despite growing concern, most firms remain underprepared and underfunded when it comes to cybersecurity.

Most Acknowledge Growing Risk

The survey covered 1,000 small businesses worldwide. An overwhelming 87% expressed concern about the cyber threats their organization might face in the next 12 months. Additionally, 83% believe their cyber risk has increased over the past year. However, this concern hasn’t translated into action.

Reality Check: Attacks Are Happening

Nearly 79% of respondents have already experienced at least one cyber attack in the last five years. Yet 64% still don’t consider themselves attractive targets. That’s despite being responsible for nearly half of all attacks worldwide, according to industry estimates.

Perceived Size Means Perceived Safety

Many small businesses believe attackers prefer larger companies. The study debunks this belief. Cybercriminals often target vulnerable systems rather than high-profile organizations. Small businesses, with fewer defenses, present easier targets.

Cybersecurity Investments Fall Short

Only 26% of surveyed businesses spend more than 10% of their budget on cybersecurity. Worse, 59% of companies dedicate fewer than 10 hours a week to cyber defense. These numbers don’t align with the threat level they face.

Misjudging the Financial Fallout

Respondents showed little consensus on the potential cost of a cyber attack to them. Some were estimated to be under $500,000, while others were over $2 million. Only 10% had never experienced a breach. The remaining majority still vastly underestimate recovery costs. One assumes they are underprotected by cyber insurance coverage. This need for protection in the form of cyber insurance is something we’ve reported extensively.

Get The Cyber Insurance Upload Delivered

Every Sunday

Subscribe to our newsletter!

Hidden Costs Add Up

Cyber incidents incur immediate expenses, including legal fees, forensic services, and fines. Longer-term effects include lost trust, damaged reputations, and leadership burnout. These risks can put a small business at risk.

Misplaced Confidence

Despite low investments, 59% of respondents believe their current cybersecurity spending is appropriate. That confidence may prove costly if they fail to reassess their approach.

Why Small Business = Easy Target

Cyber attackers are increasingly using tools like Ransomware-as-a-Service (RaaS). These tools automate the search for weak systems. Small businesses often leave digital “windows” open, making them the most vulnerable targets.

Attackers Want Efficiency, Not Headlines

Hitting one large corporation may bring fame. But compromising hundreds of small businesses can be just as profitable. Small operations offer quicker wins with less resistance.

The Need for Urgent Re-Evaluation

Coalition’s findings suggest that knowledge of cybersecurity threats alone isn’t enough. Businesses must invest wisely and act proactively to stay protected. Without meaningful change, the smallest players may suffer the greatest losses.