Estimated reading time: 2 minutes

Global Market Poised for Strong Growth –

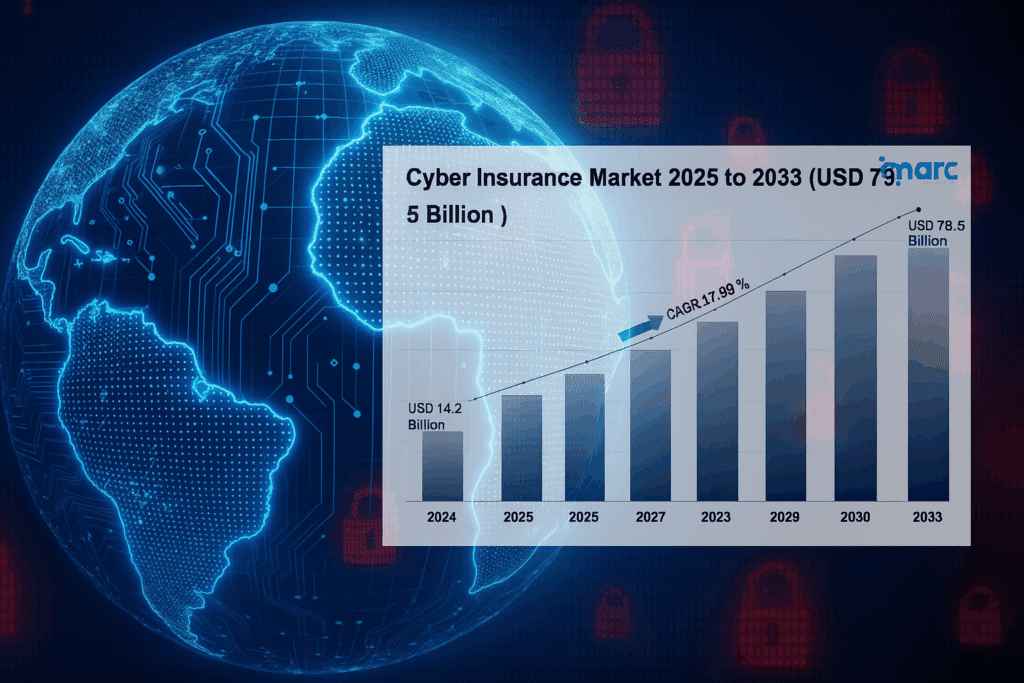

The cyber insurance market is projected to reach USD 73.5 billion by 2033. This estimate is courtesy of new research from the IMARC Group. It stood at USD 14.2 billion in 2024. This growth represents a 17.88% compound annual growth rate (CAGR) over the forecast period.

Rising Threats and Regulatory Pressure Drive Demand

Cyberattacks are increasing in frequency and scale. These threats include ransomware, which can cause significant financial and reputational damage. Regulatory requirements, such as the GDPR and CCPA, are also prompting companies to secure coverage. Fines and legal expenses related to data breaches are growing.

Small Businesses Push Market Expansion

Small and medium-sized enterprises (SMEs) are now major buyers. They face risks, but in reality, they often lack in-house cybersecurity due to the associated costs. Customized insurance products are helping them manage these risks affordably.

Insurers Shift Strategy With Targeted Products

Insurers are creating industry-specific policies. Healthcare, retail, and financial sectors are receiving tailored coverage options. This includes protections aligned with HIPAA and PCI DSS standards.

Get The Cyber Insurance News Upload Delivered

Every Sunday

Subscribe to our newsletter!

Cybersecurity Integration Gains Traction

This is the benefit a new product offers—the need to provide a comprehensive product to grow. Insurance providers now offer bundled services. These include threat detection, incident response, and employee training. Partnerships between insurers and cybersecurity firms improve risk mitigation.

Ransomware-Specific Coverage Grows

The growth of ransomware, and now ransomware-as-a-service, has driven the rise of dedicated ransomware insurance. It covers ransom payments, legal costs, and data recovery. Stronger underwriting standards now accompany this coverage.